- Buyers stay away from market ahead of holidays

- Iranian billet market witnesses conclusion of tender

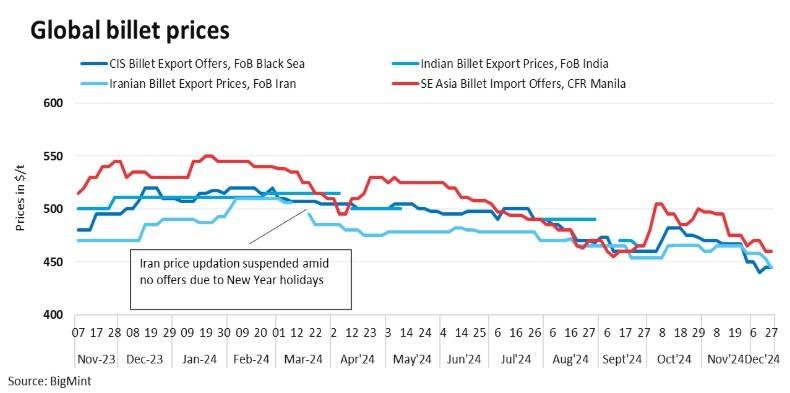

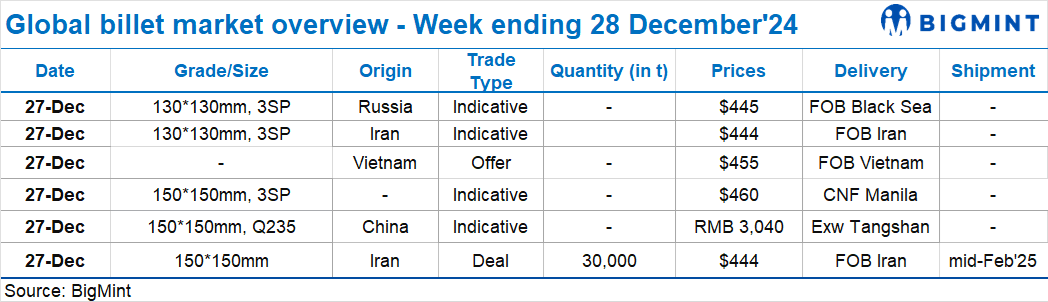

Steel billet prices in the global market remained largely stable this week. Approaching New year holidays have kept market participants away from the market, resulting in weakened sentiments amid absence of trade activities. However, in the Middle East some trades were recorded at lower levels. Also, an export tender conclusion is awaited.

However, Turkish imported ferrous scrap prices fell by $2/t w-o-w in the final week of the year driven by reduced market activity ahead of the Christmas and New Year holidays. Low rebar demand made Turkish mills hesitant to purchase more scrap, dampening market confidence and limiting the potential for any price recovery in the near term. US-origin HMS (80:20) bulk scrap stood at $349/t CFR, down $2/t w-o-w.

Market highlights

- SE Asia imported billet prices stable w-o-w: Imported billet prices in Southeast Asia remained stable this week amid weakening outlook and stagnant demand ahead of Christmas and New Year. Deals were absent as buyers have exited the market on holidays. Notably, bids for billet were at $455-460/t CFR Manila. Prices of billets (150 x 150 mm, 5SP) imported by the Philippines were heard at $460/t CFR Manila, stable w-o-w.

- Vietnam’s blast furnace (BF) grade billet export offers remained steady w-o-w at $455/t FOB on 27 December. As per sources, billet import price from Indonesia stood at $455/t CFR Vietnam. However, trade was muted.

- Iranian billet prices fall in recent trade: The Iranian billet export market witnessed the conclusion of a tender this week at lower price levels. Notably, Iranian billet prices inched down by $9/t w-o-w to $444/t FOB on 27 December. An Iranian steel mill has concluded an export tender for 30,000 t of steel billets (commercial grade) at $444/t FOB. The shipment is scheduled for mid-Feb’25. Also, another Iranian mill has floated an export tender, which is due on 28 December.

- Chinese billet prices remain stable w-o-w: Billet prices in China’s Tangshan remained unchanged w-o-w at RMB 3,040/t ($417/t), including 13% VAT, on 27 December. Weak market demand, lack of encouragement from the policy front and declining trends in rebar futures and finished steel prices have collectively exerted downward pressure on billet prices. Meanwhile, SHFE rebar futures (May 2025 delivery) dipped RMB 11/t ($2/t) to RMB 3,268/t ($448/t) on 27 December.

Article From bigmint